Donor Guide

How it works

If you have a tax liability with the state of Ohio, you can receive a 100% tax credit (dollar for dollar) for your donation to a qualified Scholarship Granting Organization (SGO), up to $750 if you file as a single filer, or $1,500 if married, filing jointly. Both individual taxpayers and pass-through entities are eligible for this tax credit.

This is a non-refundable tax credit that will reduce your Ohio state tax liability (the amount you owe in taxes). A non-refundable tax credit limits your tax benefit to no more than what you owe in taxes. The amount of the tax credit you can claim is equal to 100% of the amount you donate up to $750 per taxpayer.

Step-by-step donor guide:

Follow these simple steps to maximize your donation and tax credit:

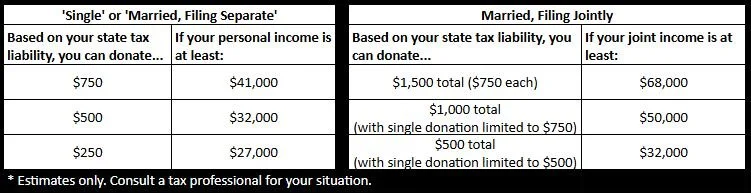

Estimate your Ohio state tax liability using an online calculator, or the chart below. This figure, up to a maximum of $750 per single filer ($1,500 for joint filers), is the maximum you can donate and receive a 100% Ohio tax credit on your donation. If you earn more than $41,000 as a single filer, or $68,000 as a joint filer, you are likely eligible to donate the maximum amount of $750 individual / $1,500 total for joint filers (consult a tax professional with any questions).

Make your donation to a qualifying SGO (like this one!). To be eligible for this credit in a given tax year, you must make your donation by the tax filing deadline for that year. For example, to claim the tax credit for the year 2024, your donation must be made by April 15, 2025. If you are donating on behalf of two taxpayers filing jointly, please make separate donations for each taxpayer to ensure you receive the full tax benefit!

Claim your donation as a tax credit when you file your Ohio state income tax return. You will have the ability to claim this credit when you file your state tax return, no matter whether you prepare your own return or work with a tax professional. You can claim this credit prior to making your donation, as long as your donation is made by the tax deadline day (for example, you may claim the credit for 2024 when filing your 2024 return in February 2025, as long as you make your 2024 donation by April 15, 2025). Note that you cannot claim the same donation as a credit for multiple tax years.

Keep your donation receipt for your tax records. After making your donation, we will send you a receipt for your donation that you should keep for your tax records.

Estimating your tax liability and maximum tax credit amount

See below for an estimate of your tax liability (maximum tax credit). You can calculate your estimated state tax liability using the Ohio Department of Taxation’s online calculator (under ‘Individual’ select ‘Calculate my income tax liability’). Please note that this should not be considered tax advice. Consult with a tax professional to determine your specific situation.

Source: https://myportal.tax.ohio.gov/TAP/_/ (under ‘Individual’ select ‘Calculate my income tax liability’)

For more information

Ohio Department of Taxation: Scholarship Donation Credit

Ohio Attorney General: Scholarship Granting Organization Certification

Ohio Attorney General: List of Certified Scholarship Granting Organizations